The Midwest Operating Engineers Pension Plan is a defined benefit Plan based on a set formula, and will be paid on a monthly basis for the member’s lifetime. At retirement, married participants can elect a lifetime survivor benefit for their spouse in the event the member dies.

It is imperative that you read and share with your family the Pension Plan’s Summary Plan Description (linked above) which outlines all of the benefits in further detail.

If you have any questions or you are considering retirement within the next six months, please contact the Retirement Services Group at (708) 579-6630.

On Sunday, November 20th, members age 59-65 were invited to attend a meeting to learn more about the Worker Retention Program (WRP), which was approved by Pension Fund Trustees earlier this month in an effort to meet the current need for skilled workers.

The program will provide an incentive for members who choose to work past their normal retirement age in order to address the immediate labor needs as well as offset any costs of the incentive to both the Pension Fund and the Retiree Welfare Plan. Click here to view the WRP presentation.

Under the program, members who work at least one year past their normal retirement age and work at least 800 hours in that year would be eligible for a WRP benefit. For each month an eligible member worked past their normal retirement age, he or she would accumulate a WRP benefit equal to his or her accrued benefit at Normal Retirement Age. That is, the pension benefit that a member would receive had he or she retired would be set aside and paid out upon retirement as a WRP benefit in addition to pension benefits at that time.

In accordance with federal guidelines and restrictions, that benefit would be paid out in monthly installments that cannot exceed that member’s Social Security Benefit at Normal Retirement Age.

The total accumulated benefit would be paid out in monthly installments until:

- member reaches Social Security Normal Retirement Age, or

- accumulated benefits are paid out in full.

Each member’s circumstances are different, and the Retirement Services Group will be available to assist members as they near retirement on the potential benefits of the WRP to them.

All members are allowed to “un-retire” once, so members who are currently retired may want to consider the program as well.

This is not a vested benefit. It is structured as a temporary benefit within the confines of federal law, and at the discretion of the Trustees, the program can modify or end the WRP if labor conditions warrant.

Important Letters/Notices:

- WRP Frequently Asked Questions

- Letter for Members approaching Normal Retirement Age

- Letter for members continuing to work past their Normal Retirement Age

- 2022/2023 Pension Fund- Active Members- Summary of Material Modifications

If you are under 65 and have already retired, and have questions about the WRP, please call MOE Retirement Services at (708) 579-6630.

The monthly vested accrued benefit is determined based on the following factors:

- Employer contributions based on the rate(s) specified in the member’s collective bargaining agreement (CBA) multiplied by

- Multiplier in effect at the time of the Employer Contributions are contributed multiplied by

- Vested Percentage

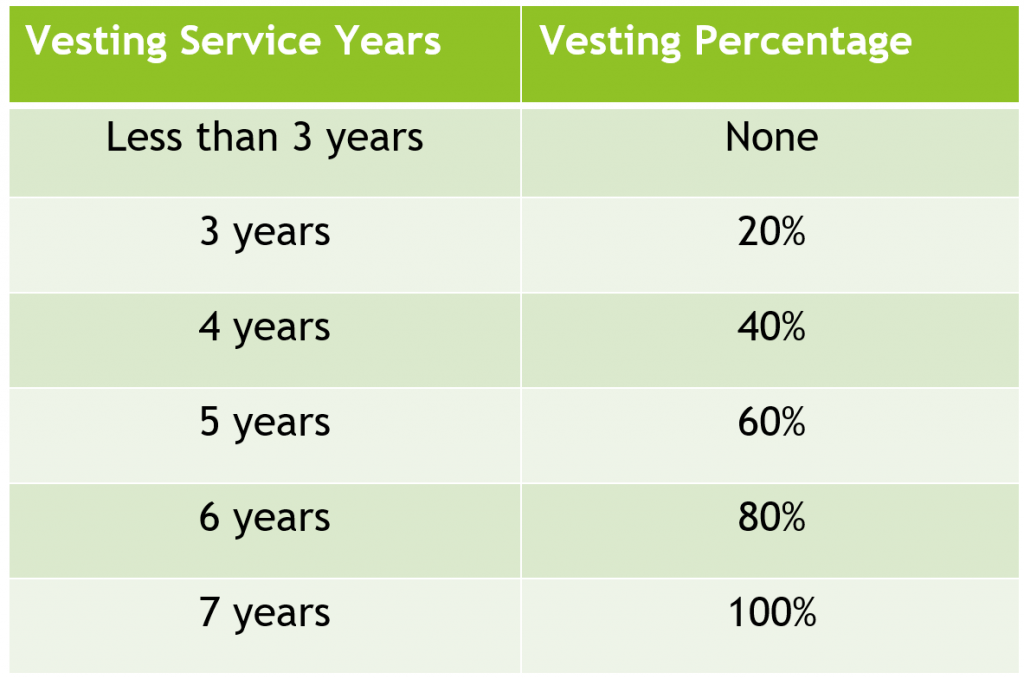

Your vesting percentage is your nonforfeitable right to a monthly pension benefit. You automatically receive one Vesting Service Year for your first hour worked in your first Plan Year. The Plan Year is from April 1 – March 31. For every 500 hours worked in a Plan Year, you will receive one Vesting Service Year.

The current Vesting Service schedule is as follows:

Each Pension type has certain eligibility requirements that must be met.

-

- Monthly Pension Benefit (Early, Normal, Vested) payable for your lifetime

- Death Benefits

-

-

- Pre-Retirement death benefit

- Post retirement lump sum death benefit

- Post retirement surviving spouse monthly benefit payable for spouse’s lifetime

-

- Disability Benefit (Operating Engineer or All Work)

Refer to your Summary Plan Description for specific requirements.

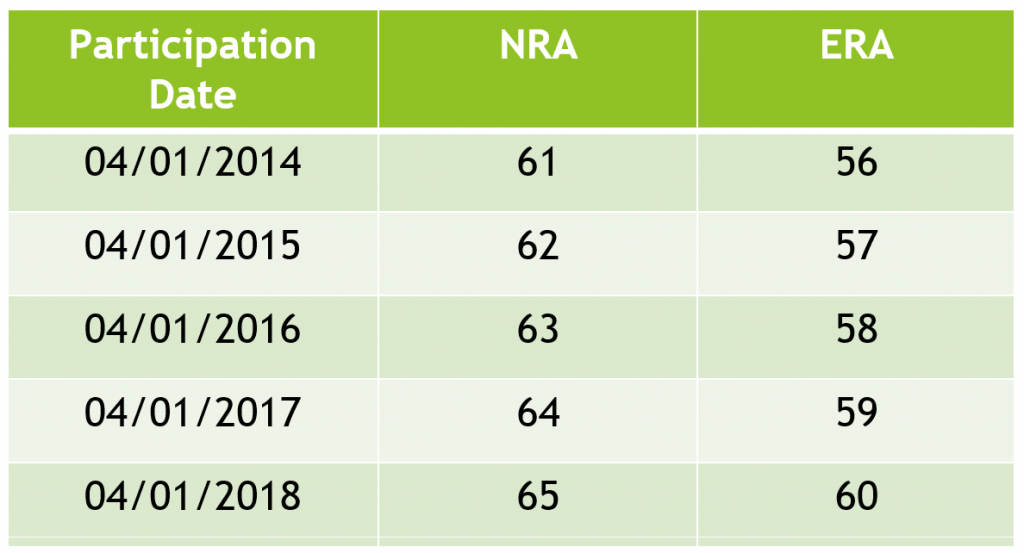

Generally, for both Normal Retirement age (NRA) and Early Retirement Age (ERA), for Participants that have 10 Vesting Service Years at retirement and who have first Hour of Service in Covered Employment on or after:

Reduction for Early Retirement is 3% per year of .25% per month for which benefits commence prior to your NRA.

Normal Forms of Payment:

- Single: 5 Year Certain & Life

- Married: Joint & 50% Survivor

Optional Forms of Payment:

- 10 Year Certain & Life

- Joint & 75% / 100% Survivor

- Joint 50% / 75% / 100% Survivor with Pop-Up

- Accelerated level income on all optional forms of payment

If you and your spouse elect one of the Joint & Survivor options, subsequent to the members death, the spouse’s monthly benefit will be payable based on the elected % and payable over your spouse’s lifetime.

Once you have received your first benefit payment, your benefit option may not be changed.