Welcome to the Non-Marketplace Plans for Monthly Members

The Midwest Operating Engineers Welfare Fund also provides coverage for our monthly members under the Non-Marketplace health plan options. Depending on which Collective Bargaining Agreement you fall under, there are a host of benefits available. If you’re considered a monthly member, your Employer pays your monthly health and welfare coverage and eligibility is month-to-month. It’s also important that you and your eligible dependents take advantage of the FREE services provided by the Welfare Fund.

The health plan options available to monthly members are broken down into the following categories:

Legacy Plans (these members do not participate in the open enrollment process) include the following plans and will provide coverage for a single member or family:

- A-3 Non-Bargaining Employees

- A-5 Municipality Monthly

- B-1 Monthly (formerly Plantsmen)- If you are a Landscape Contractor with a new employee, see the “What are the new employee procedures for Landscape Contractors?” dropdown below for new employee procedures.

- E-1 Monthly (formerly Landscapers)

- F-1 Monthly (Staff)

Owner-Operator/Relative Shareholder (Please see question below for available health plan options)

3-tier Municipalities (Please see question below for available health plan options)

Owner-Operator/Relative Shareholder and 3-Tier Municipality members are eligible to participate in the annual Open Enrollment process. Annual Open Enrollment takes place from mid-January through February. During Open Enrollment, you have the opportunity to select your health plan option and/or coverage tier. As long as you actively enroll, through your My150 account, into a health plan option, either by selecting Start New Plan or Keep Current Plan, your newly validated dependents will be added to your coverage. If you do not participate in the open enrollment process, you will default into the same health plan option and coverage tier with the same dependents and no newly validated dependents will be added for coverage.

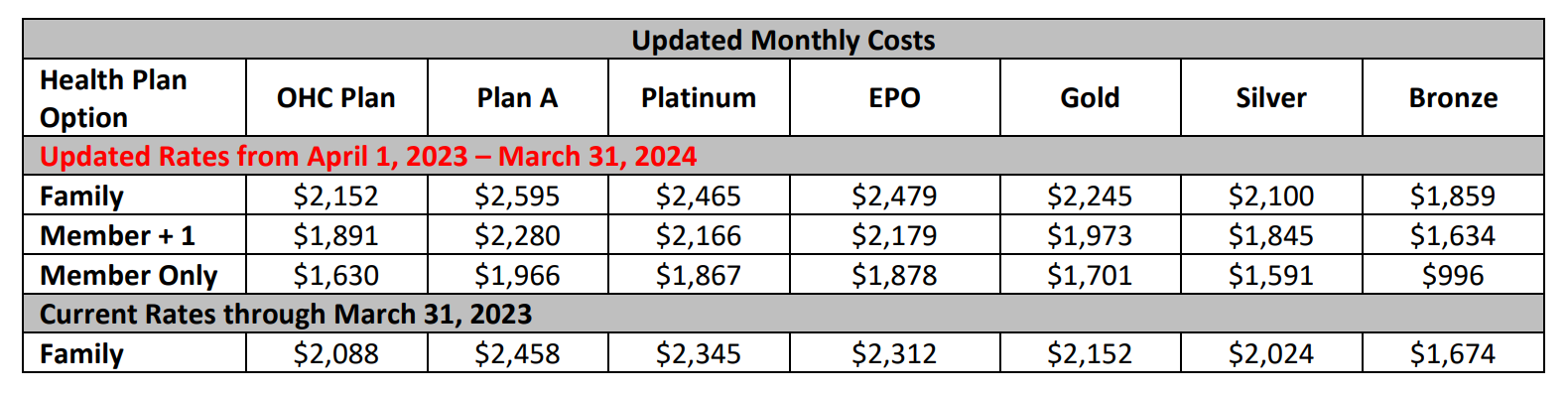

Owner-Operator/Relative Shareholder is required to select one of the following health plan options during the annual open enrollment:

In January of each year, you will receive your open enrollment packet which will contain all the information that you will need in order to make an informed health care option decision. You can access the details of your health plan option by logging into your My150 account and click the VIEW PLAN DETAILS button on your current health plan tile.

3-Tier Municipalities are required to select one of the following health plan options and coverage tiers (Single, Member +1, Family) during the annual open enrollment process as discussed below.

- Municipality Plan A PPO

- Municipality EPO Plan

- Municipality OHC Plan for select Municipality groups

In January of each year, you will receive your open enrollment packet which will contain all the information that you will need in order to make an informed health care option decision. You can access the details of your health plan option by logging into your My150 account and click the VIEW PLAN DETAILS button on your current health plan tile.

You can access the details of your health plan option by logging into your My150 account and click the VIEW PLAN DETAILS button on your current health plan tile.

3-tier Municipalities – If you terminate employment and lose coverage under the Welfare Fund, you can elect COBRA Coverage. You can elect to continue coverage through the plan you are enrolled in, or you can select a lower coverage tier and/or different health plan option.

Owner-Operator/Relative Shareholder – If you terminate employment and lose coverage under the Welfare Fund, you can elect COBRA Coverage. You can elect to continue coverage through the plan you are enrolled in, or you can select lower costing health plan option.

Legacy Plans (except Plan B) – If you terminate employment and lose coverage under the Welfare Fund, you can elect COBRA Coverage.

Plan B (Formerly Plantsmen) – As a Plan B member, there are a few ways to continue your eligibility under the Welfare Fund.

- Self-Payments – You can make up to four consecutive monthly self-payments during each eligibility period. The self-payments will allow you to extend coverage for the four months.

- COBRA Coverage – After you make all four self-payments, you will be offered COBRA coverage. The Fund Office will send you a letter regarding the COBRA payments.

It is extremely important to maintain your eligibility under the Welfare Fund. Also, depending on your age and when you are eligible to retire, this may affect whether you are eligible for the Retiree Welfare Plan (RWP) as you may jeopardize meeting the RWP service requirement for coverage. If you select COBRA coverage, the months covered will be counted towards the RWP service requirements. Please Note: Some Legacy Plans and Plan B members do not have access to RWP coverage. If you have additional RWP eligibility questions, please call the Eligibility & Benefit Services Group at (708) 937-0327.

The Accounts Receivable Department at the Midwest Operating Engineers Fringe Benefit Funds’ office has updated the new employee procedures for our Landscape Contractors. The purpose for these changes will decrease the wait time for when a member’s Welfare Fund coverage will commence, decrease the processing time on your end, and to better serve the members of Local 150.

Please complete the following steps under the new procedures:

- Complete the New Employee Information Sheet AND

- Complete only one of the following:

- 2022 New Hire Form for Monthly Junior Plantsmen (English Version / Spanish Version) OR

- 2022 New Hire Form for Monthly Plantsmen (English Version / Spanish Version)

- Fax the two forms above to the AR department at (708) 482-3756 to the attention of Lucia Urquizo as soon as possible.

- Once received, the AR department will manually input the employee’s information into our system.

- When reporting this same employee through the I-REMIT system, input the report for the appropriate contract and month.

- At the bottom of screen, you will see “New Employee” for which you will type in the SSN and the first four letters of the new employee’s last name.

- Double click on the “Add” button.

By following the above steps, the new employee’s name will appear in I-REMIT and you will no longer need to add the information separately, as long as you have previously faxed the information to us as noted in steps 1-3 above.

If you have any questions or concerns, please contact Lucia Urquizo at (708) 579-6620 ext. 5683.